- No products in the cart.

Stamp duty is a state and territory tax that many Master Builders Associations want to see reformed

As state and territory governments search for policies to support economic recovery, stamp duty reform is inevitably in focus. Master Builders Australia’s Chief Economist Shane Garrett sets out the arguments in favour of stamp duty changes.

The ills attributed to stamp duty are well known. The tax on the buying and selling of homes has long been blamed for impeding the movement of people around the country. For the labour market, this means that individuals are often prevented from taking up work opportunities that better match their skills set. For retirees, stamp duty penalises them for downsizing their living arrangements. As a result, opportunities to make larger dwelling stock available on the market are lost.

Today we step back and have a look at the simple financial cost to homebuyers of paying stamp duty when they buy a home. Stamp duty rates and calculations differ widely across the states and territories. The way in which the tax is levied also varies according to the characteristics of the homebuyer, as well as the type of property involved in the transaction.

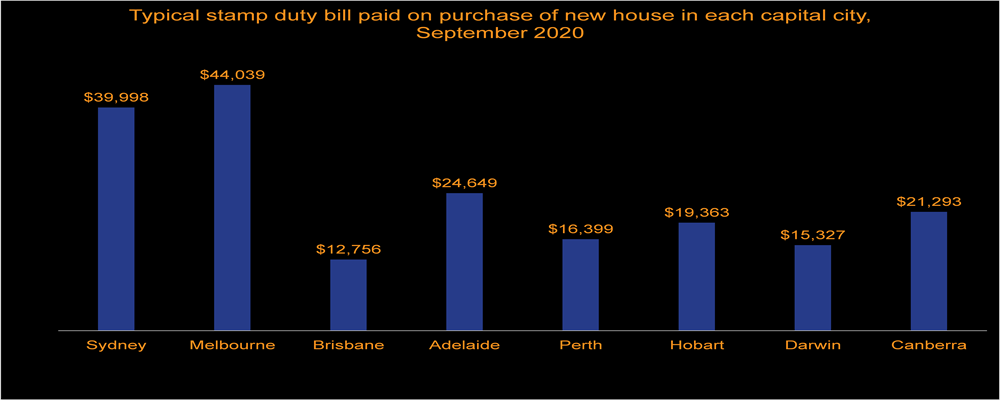

For the sake of comparability and simplicity, we focus here on the purchase of a new home by an owner occupier. The chart below shows how the typical stamp duty bill varies across the eight capital cities. It should be stressed that these results are based on the median house price in each capital city during August 2020. The variation in house prices is the single largest factor behind the big differences in stamp duty bills from city to city. For example, the median house prices in Sydney ($968,000) and Melbourne ($782,000) are in sharp contrast to prices in Perth ($462,000) and Darwin ($476,000).

On this basis, the typical stamp duty bills is highest in Melbourne ($44,039), Sydney ($39,998) and Adelaide ($24,649). At the bottom of the stamp duty ladder is Brisbane ($12,756), followed by Darwin ($15,327) and Perth ($16,399).

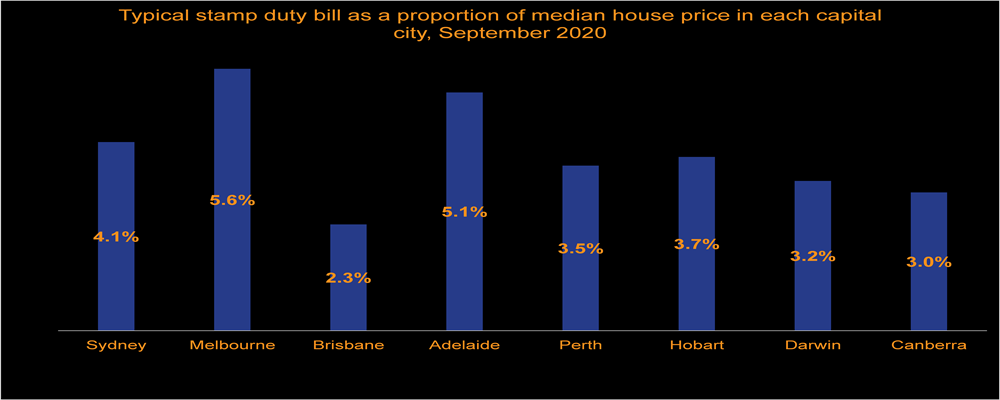

Given the wide divergences in house prices from place to place, it is probably more meaningful to compare stamp duty bills in terms of their share of the overall house price. By this measure, Melbourne again performs worst: in Victoria’s capital, the typical stamp duty bills is equivalent to 5.6% of the price of the house. Interestingly, the stamp duty burden is next higher in Adelaide (5.1%) followed by Sydney (4.1%).

In this way, Brisbane again compares best with stamp duty adding 2.3% to the cost of buying a new house. Next lowest is Canberra (3.0%) and then Darwin (3.0%).